Definition of Perpetuity

A perpetuity is a financial instrument that provides

an infinite series of cash flows, typically in the form of fixed payments, that

continue indefinitely. In simpler terms, it's a type of investment that pays a

constant amount of money forever, without an end date. The present value of a

perpetuity can be calculated using the formula:

r

Where 'C'

In finance, perpetuity refers to an investment or cash

flow that provides an infinite series of payments at regular intervals. These

payments continue forever, making perpetuities a unique concept in valuation

and investment analysis.

Key Characteristics:

1.

Infinite

Duration: Unlike typical investments that

have a fixed term, perpetuities pay out indefinitely.

2.

Fixed

Payments: The cash flows are usually

constant and do not change over time.

3.

Present

Value Calculation: The present value of a perpetuity

can be calculated using the formula:

C

Present Value

r

Common Applications:

- Preferred

Stock: Some preferred stocks behave

like perpetuities because they pay fixed dividends indefinitely.

- Real Estate Investments: Certain real estate assets can provide continuous income, similar to a perpetuity.

The differences between Perpetuity and Annuity can be shown

as following table:

|

Topic |

Perpetuity |

Annuity |

|

Duration |

Provides cash flows indefinitely, with no end date |

Provides cash flows for a fixed period (e.g., 10, 20, or

30 years) |

|

Cash Flows |

Payments are constant and occur at regular intervals

forever. |

Payments are usually constant and occur at regular

intervals, but they stop after the specified term. |

|

Present Value

Calculation |

Calculated using the formula C Present Value=-------- r |

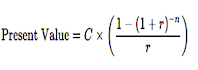

Calculated using the formula |

Example:

Suppose you purchase a preferred

stock that pays a dividend of $100 per year. Since it pays this amount

indefinitely, its present value can be calculated using the formula for

perpetuity:

C

Present Value=-------- . . r

Where:

- PV = present value of the perpetuity

- C = cash flow per period (in this case, $100)

- r = discount rate (let's say 5% or 0.05)

Substituting the values:

100

PV= -------- . . . 0.05

In this example, the present value

of the perpetuity would be $2,000. This means if you were to invest $2,000 at a

5% return, you would receive $100 each year indefinitely.

What is a

growing perpetuity

A growing perpetuity is a financial concept that refers to a

stream of cash flows that continue indefinitely and grow at a constant rate

over time. It can be thought of as a series of payments that will never end,

where each payment increases by a fixed percentage each period.

The formula to calculate the present value of a growing

perpetuity is:

C

PV = ------------

r - g

where:

- PV is the present value of the

growing perpetuity,

- C is the cash flow in the first

period,

- r is the discount rate (or the

required rate of return),

- g is the growth rate of the cash

flows.

This formula applies as long as the discount rate (r) is greater

than the growth rate (g). If the growth rate is equal to or exceeds the

discount rate, the present value would be infinite or undefined. Growing

perpetuities are often used in financial modeling, particularly in valuing

stocks and real estate investments.

Difference between Perpetuity and Royalty

The differences between Perpetuity and Royalty can be shown

as following table:

|

Particular |

Perpetuity |

Royalty |

|

Definition |

A perpetuity is a financial instrument that provides a

stream of cash flows that continues indefinitely. It is often used in valuing

assets or investments. |

A royalty is a payment made to a property owner (such as a

patent holder, artist, or author) for the use of their asset. It typically

involves licensing rights to use intellectual property or natural resources. |

|

Cash Flows |

The payments can be fixed (like a traditional perpetuity)

or grow at a constant rate. |

Royalties are often calculated as a percentage of revenue

generated from the use of the asset. |

|

Duration |

The cash flows are expected to last forever, hence the

name. |

Royalties can be for a specific period or until certain

conditions are met, but they don’t necessarily last indefinitely. |

Tracking a Business's Perpetuity Effectively

Tracking a business's perpetuity effectively involves

several steps to ensure you accurately assess the value of the cash flows

expected to continue indefinitely. Here’s a structured approach:

1. Understand Cash

Flows

- Identify Cash Flows:

Determine the cash flows generated by the business, such as profits, dividends,

or other income streams.

- Consistency:

Ensure these cash flows are consistent and reliable, ideally based on

historical data.

2.

Estimate Growth Rate

- Analyze Historical Growth: Look at

historical revenue and cash flow growth rates to establish a baseline.

- Market Research: Consider industry

trends, economic conditions, and competitive landscape to forecast future

growth.

- Set a Reasonable Growth Rate: Choose

a sustainable growth rate that reflects long-term potential without being

overly optimistic.

3.

Determine Discount Rate

- Weighted Average Cost of Capital

(WACC): Calculate the WACC to serve as your discount rate. This rate reflects

the cost of financing the business through debt and equity.

- Risk Assessment: Factor in the

business's risk profile; higher risk typically means a higher discount rate.

4. Apply

the Perpetuity Formula

- Use the present value formula for a growing perpetuity

5.

Regularly Review and Update

- Periodic Assessments: Regularly

revisit your cash flow estimates, growth rates, and discount rates as market

conditions and business performance change.

- Adjust for Changes: If there are

significant changes in the business environment, adjust your calculations

accordingly.

6.

Document Assumptions

- Maintain Transparency: Clearly document all assumptions used in your calculations for future reference and to support decision-making.

- Scenario Analysis: Consider performing sensitivity analyses to see how changes in your assumptions affect the valuation.

7. Consult

Professionals if Needed

- Financial Advisors: If you're unsure

about the calculations or assumptions, consider consulting financial analysts

or valuation experts.

8. Use

Financial Software or Tools

- Valuation Models: Utilize financial

modeling software or spreadsheet tools that can help automate and simplify the

calculations.