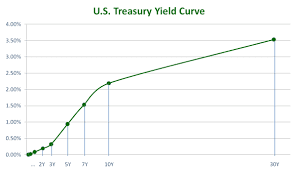

The yield curve is a graphical representation that shows the relationship between interest rates (or yields) of bonds of different maturities, typically government bonds, at a given point in time. It is an essential tool in finance and economics, providing insights into the overall economic environment, interest rate expectations, and investor sentiment.

Key Features of the Yield Curve:

Axes:

- The horizontal axis represents the time to maturity (from short-term to long-term).

- The vertical axis represents the yield (interest rate) on the bonds.

Shapes of the Yield Curve:

- Normal Yield Curve: Upward-sloping, indicating that longer-term bonds have higher yields than short-term bonds. This reflects the expectation of economic growth and inflation, leading to higher interest rates in the future.

- Inverted Yield Curve: Downward-sloping, where short-term yields are higher than long-term yields. This can signal an upcoming recession, as investors expect economic slowdown and lower interest rates in the future.

- Flat Yield Curve: When yields across different maturities are similar, indicating uncertainty about future economic conditions. It can reflect a transition phase in the economy.

Factors Influencing the Yield Curve:

- Interest Rates: Central bank policies (like changes in the federal funds rate) can shift the yield curve.

- Inflation Expectations: Higher expected inflation can lead to higher yields, particularly on longer-term bonds.

- Economic Growth: Strong growth can push yields higher as demand for capital increases.

- Investor Sentiment: Risk appetite and market sentiment can influence the demand for bonds of various maturities.

Importance of the Yield Curve:

- Economic Indicator: The shape of the yield curve can provide insights into future economic activity, such as growth or recession expectations.

- Investment Decisions: Investors use the yield curve to make decisions about bond investments, including duration and interest rate risk.

- Pricing of Financial Instruments: The yield curve helps in pricing various financial products, including derivatives and mortgages.

Shifts in the Yield Curve:

- The yield curve can shift due to changes in economic outlook, interest rate changes by central banks, or shifts in inflation expectations. These shifts can affect bond prices and yields across different maturities.

Conclusion

The yield curve is a vital tool for understanding interest rate dynamics and economic conditions. By analyzing its shape and movements, investors, economists, and policymakers can make informed decisions regarding investment strategies, economic forecasts, and monetary policy.