The payback period is one of the most straightforward and widely used methods for evaluating investment projects in finance. It measures the time required for an investment to generate cash flows sufficient to recover the initial cost. This metric is especially valued for its simplicity, making it a popular choice among financial managers and small business owners. Here's a comprehensive guide to understanding and applying the payback period in financial decision-making.

What is the Payback Period?

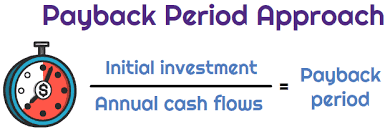

The payback period is the duration it takes for an investment to "pay back" its initial cost through net cash inflows. It is calculated using the formula:

For instance, if an investment of $50,000 generates $10,000 annually, the payback period is:

Why is the Payback Period Important?

- Simplicity and Clarity : The payback period is one of the simplest financial metrics to calculate and understand. It provides a clear timeframe for recovering an investment, making it an accessible tool for decision-makers, including those without extensive financial expertise.

- Focus on Liquidity: Liquidity is vital for businesses, especially those operating in cash-sensitive industries. The payback period highlights how quickly an investment can convert into cash, which is essential for managing short-term financial obligations and ensuring operational stability.

- Risk Assessment: A shorter payback period generally indicates lower investment risk. Recovering the initial cost quickly reduces the exposure to uncertainties such as market volatility, changing regulations, or economic downturns. This makes the metric especially useful in high-risk environments.

- Decision-Making: The payback period acts as a quick screening tool to prioritize investments. Businesses can set a target payback period and accept only those projects that meet the criteria, streamlining decision-making and focusing on opportunities with faster returns.

- Useful for Small Businesses and Startups: For small businesses and startups with limited capital, ensuring quick returns on investment is crucial. The payback period helps these entities assess projects that can generate cash flow rapidly, supporting their growth and sustainability.

- Short-Term Investment Evaluation: For projects with short lifespans or where the primary goal is to recover costs quickly, the payback period is an ideal metric. It ensures that funds are recouped before the asset becomes obsolete or unprofitable.

- Initial Screening Before Advanced Analysis: While the payback period does not consider profitability beyond the recovery point, it is often used as a preliminary tool before applying more complex metrics like Net Present Value (NPV) or Internal Rate of Return (IRR). This saves time and resources by narrowing down options.

How to Calculate the Payback Period

1. Even Cash Flows:

When annual cash inflows are consistent, divide the initial investment by the annual cash inflow.

Example:

- Initial Investment: $100,000

- Annual Cash Inflow: $25,000

- Payback Period: $100,000 ÷ $25,000 = 4 years

2. Uneven Cash Flows:

- Initial Investment: $50,000

- Year 1: $10,000, Year 2: $15,000, Year 3: $25,000

- Payback Period: 3 years (as the cumulative inflows total $50,000 by Year 3).

Advantages of the Payback Period

- Quick Evaluation: It provides a rapid assessment of an investment’s viability.

- Focus on Cash Flows: Prioritizes projects with faster returns, which are crucial in cash-sensitive industries.

- Easy to Understand: Ideal for non-finance professionals or small business owners making investment decisions.

Limitations of the Payback Period

- Ignores Time Value of Money (TVM): It does not account for the diminishing value of money over time, unlike discounted cash flow methods.

- Excludes Post-Payback Cash Flows: Focuses only on recovering the initial investment, ignoring profitability beyond the payback period.

- No Standard Benchmark: The acceptable payback period varies across industries and companies, making it less reliable for universal comparisons.

Improving Payback Period Evaluation

Incorporating Discounted Payback Period

To address the limitation of ignoring TVM, finance professionals often use the discounted payback period. This method calculates the time required to recover the investment based on discounted cash flows, providing a more accurate assessment.

When to Use Payback Period Analysis

- Short-Term Investments: Ideal for projects where quick cash recovery is critical.

- High-Risk Environments: Shorter payback periods minimize exposure to volatile market conditions.

- Preliminary Screening: Useful as an initial filter before applying more detailed financial analyses.

Conclusion

The payback period is a powerful, simple tool for evaluating investment decisions, particularly when time and resources are limited. While it has certain limitations, its ease of use and focus on cash recovery make it a staple in financial analysis. For more robust decision-making, combining it with other metrics like Net Present Value (NPV) or Internal Rate of Return (IRR) ensures a comprehensive evaluation.

By understanding the nuances of the payback period and its applications, businesses can make more informed, confident investment choices.